Let us see what New York Life predicted for my policy. The insurance

Cash Value Curve is straight from NYL, with no modifications made by me.

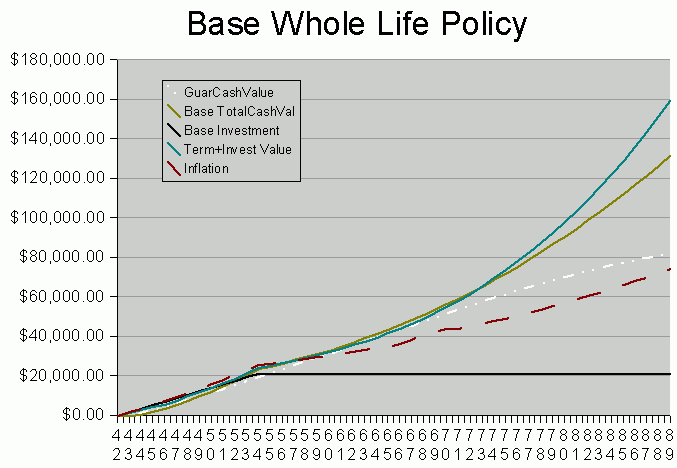

Let us examine this graph line by line, beginning with the topmost one.

If you wish to reference the graph while reading the description, click

it. A smaller version will appear in a different window, one that stays

in front. Don't worry! It will go away when you click it closed.

- The solid turquoise line represents the the minimum T+I strategy.

This model is mine, not part of the NYL illustration. It

represents an earnings rate of about 6.75% on the invested portion.

Up to age 71, it must use $485/year to pay for term insurance.

After that, the load is removed, and you can see that then it finally

takes a permanent lead.

- The solid brown line represents projected Total Cash Value.

This line starts low but catches up with min T+I for a few

years. It takes it about

10 years to cross-over the cost line and 15 years to cross-over

inflation. The curve is a bit

misleading during the first few years. Should I need to

"lapse the policy" (cancel it), the premium paid for the year

will be pro-rated with the number of months that have passed.

This pro-rated value is not represented by the curve.

(Should I die instead, the premium will also

be pro-rated. In case of death, the pro-rating is a

proportional return for the policy months I happen to be

dead. In case of simple lapse, the pro-rating is less

generous but still significant.)

- The dashed and dotted white line represents Guaranteed Cash Value.

Even if there are no dividends reinvested in the policy, it will

still gain Guaranteed Cash Value (GCV) each year, beginning at the

end of the third year. The policy's death benefit would

remain flat at $100,000. This could happen in two ways:

- NYL does not meet its earnings projections.

In this event, the policy might earn dividends from

zero dollars to anything less than the projected amount.

Should a significant projection failure occur, the insurance

company loses a lot of credibility to its customers, and many

will choose to lapse (cancel) their current policies.

In my opinion, it would be

similar to a Money Market Mutual Fund which cannot sustain

its earnings and has to allow price per share to drop below

$1. "Breaking the buck" could happen in such a fund,

but the loss of prestige (and loss of people

who choose to invest in it) have made such an event

unlikely among any of the major mutual fund families.

- The policy owner chooses not to reinvest his dividends.

The default option for dividends is to use them to purchase

Paid-Up Additions. This additional insurance is the means

used to keep dividends and their cash value within the

policy, and which raises the death benefit over time.

The other options are:

- Get a check from NYL each year.

You can do anything you want with the dividend money.

Throw a party, even. Or perhaps try a sixth

insurance strategy -- "buy Whole Life, and invest

the dividends yourself". (I have not modeled

this one.)

For tax purposes, the dividend check is considered

a partial rebate of your premium, and it is not

initially taxable. After many years,

the dividend may be higher than your premium,

in which case the difference would be considered

taxable income.

- Have NYL put the dividend into an interest-bearing account.

I am not sure why anyone would want to keep the money

with NYL but not reinvest it back into their policy,

but it is one of my options.

- Use the dividend as partial payment of next year's premium.

I could have begun lowering my premium payments beginning

the third year. The dividend would be part of

the next year's premium, and I would write a check

for the difference. No "compounding" of the

dividend amounts would occur over time; that is,

re-invested dividends would not be earning dividends

of their own. Thus it would take much

longer than 12 years (the projected time under

the reinvest option) to get to the point where

dividends and other accumulated value could fully pay

the premium.

- Inflation is the dashed red line in the center.

- The solid black line represents out of pocket dollars.

This is expected to be $1764/year for the first 12 years.

After that, NYL predicts, but does not guarantee, that policy

earnings will be sufficient to pay the premium.

Fred the Actuary predicts that I am going to die around age 79. I hope

he is wrong, and I let the graph continue to age 89 just to spite him.

Has a "buy term and invest the difference" strategy been shown to be the

best to follow? When minimal money goes into the whole life

insurance policy, it would seem so.

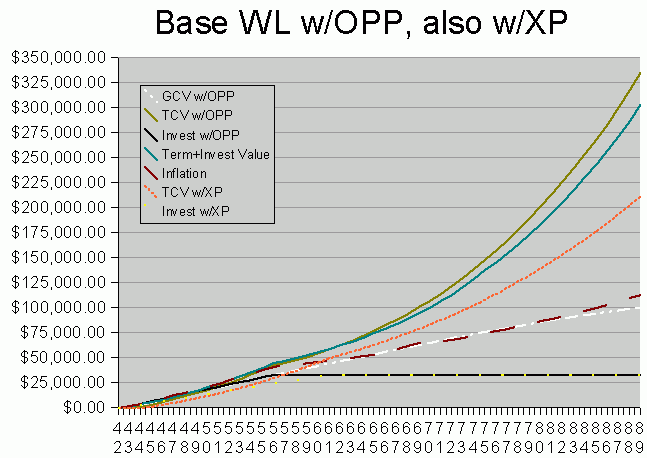

Now let us make things more interesting. Modify NYL's illustration

with my front-loading of Paid Up Additions ("PUA", aka "OPP" for "Option

to Purchase Paid

-Up Additions").

This chart is crowded during the early years. One reason

for this is that it displays both a front-loaded and a back-loaded case

for the same out-of-pocket dollars. I had done the front-loaded (OPP)

case first, but then I began to wonder what would happen if someone simply

kept paying the annual premiums until such time as no sell-backs of

PUA would be necessary. This resulted in the Extra Payment (XP) lines.

- The solid brown line represents Total Cash Value for the OPP strategy.

This is my intended strategy and primary model.

Basically I plan to invest $2400/year for 12 years. This is

about 1/3 more than my actual premium payment of $1764. In year

13, $2200 is paid, and in year 14, $2000 is paid. After that,

the policy is expected to be fully self-sustaining.

(This is the same investment schedule as the max Term+Invest curve.)

Cross-over with cost occurs at year 9, and with inflation at

year 12. Cross-over with the T+I strategy occurs at year

21. The drain of term payments eventually cost T+I its lead.

In exact opposition, the high

LIV (linear increase in value) of the

OPP strategy adds hundreds of dollars of cash value each year.

- The solid turquoise line represents the "max" T+I strategy.

Using the same investment schedule as OPP, this strategy keeps a small

lead for two decades. Proportionally, the $485/year spent for

term insurance is smaller than for min T+I, and at age 71 there is

barely a ripple when this term load is removed.

- The dashed orange line represents Total Cash Value in the XP strategy.

The normal premium payment is made for about 7 more years than in the

Base Policy strategy (18 years at $1764, with $1248 paid in 19th year).

The sum of premiums is still $33,000 as in OPP, but you can see that

spreading it out over more years reduces overall gain. The major

advantage of this strategy over the Base Policy is that dividends are

fully able to make the premium payments when the out-of-pocket period

stops. In Base Policy, value already accumulated within the policy

had to be sold back for several years; the dividends were not high

enough after just 12 years to fully cover the cost of premiums.

- Inflation is again the dashed red line in the center.

For simplicity, I only show inflation for the OPP case, not the

XP case. The XP investment would cross-over it's true

inflation line much sooner than this chart would indicate.

- The dashed and dotted white line represents Guaranteed Cash Value.

It applies to the OPP strategy, not the XP. When I directly

purchase paid-up additions, there is a corresponding increase in

guaranteed value, but making extra premium payments does not modify

any guaranteed values. So guaranteed value for the XP strategy

is exactly the same as it is for the Base WL strategy in the

first chart.

- The black line which goes horizontal is out-of-pocket dollars.

This is at a total investment of

$33,500 compared to $21,168 in the Base Policy case above.

- The yellow dots are out-of-pocket dollars in the XP strategy.

They represent a linear $1764/year until $33,000 is expended.

If this model is correct, my hypothesis is verified.

Front-loading cash into the back-loaded earning design of my

policy results in significant gain improvement. Here is a

tabular summary of the modeled strategies:

| Model Summary, Age 42 thru 79 |

| Strategy |

Invested -> Value |

Absolute Gain |

Inflation Gain |

| T+I min |

$21,168 -> $92,671 |

338% |

$55,411 67% |

| Base CV |

$21,168 -> $86,772 |

310% |

$55,411 57% |

| T+I max |

$33,000 -> $174,070 |

427% |

$84,338 106% |

| CV w/XP |

$33,000 -> $133,349 |

304% |

$79,078 69% |

| CV w/OPP |

$33,000 -> $190,159 |

476% |

$84,338 125% |

(There is no T+I model mate for the XP case. Comparing

it with the Base Policy case is instructive, however. Base "beats" XP in

absolute gain, but loses to XP in both reality and inflation gain. That

is because by year 12, the Base Policy case has "invested" all of its money,

and every year after that, the entirety is subject to inflation.

However, it is not until policy year 19 that all of the XP investment has

been made. Thus the total effect of inflation is less than the Base

case.)

Why does the OPP case beat its T+I mate, but the Base Policy case lose

to its mate? The return on the Base Policy case is damaged during

nine years of PUA sell-backs. This saves out of pocket expenses,

but hinders the "investment" properties of the policy. On the other

hand, the OPP case intentionally overfunds the policy. Not only

does nothing need to be sold back, but gain begins from the very first

policy year.

There is no magic, or "cheating", or getting money for nothing.

Given the choice to wait

years for gains to begin to accrue or begin getting a return

right away, it just made sense not to wait. Ricky says:

100% loss is not good.

-- Ricky's Little Book of Financial Truisms

By listening to him this time and not accepting the extremely

high losses the first two years, I seem to be on track to

something better. Thanks, Ricky!