| spacer |

Everyone Should Try to Participate

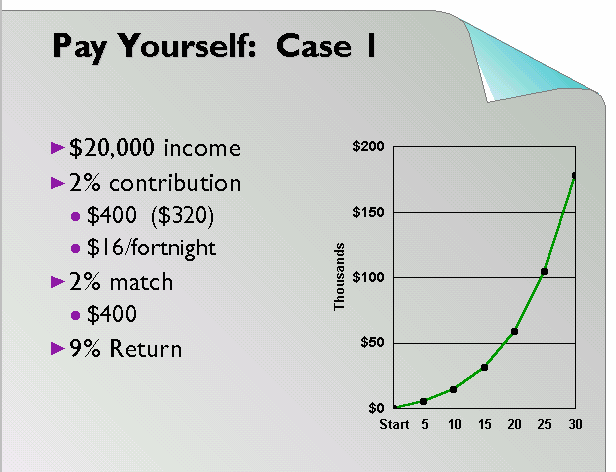

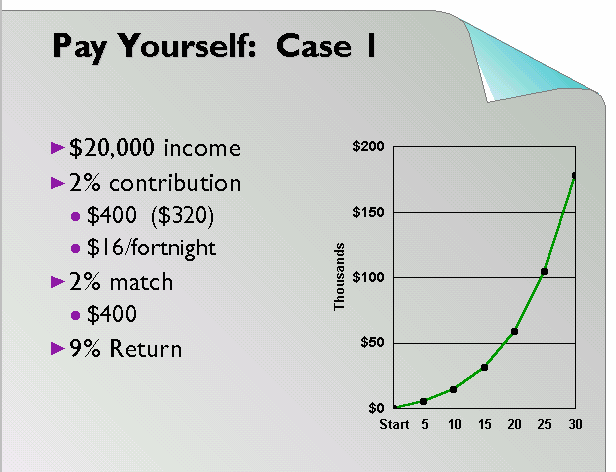

Even if you think you cannot afford participating in the 401(k) plan, please consider it. This chart and the two which follow show how almost anyone can build up a large amount over time. Let's assume you earn about $20,000/year (a bit less than $10/hour). If you can only manage to put 2% of your income into the plan, this is still $400/year. DBA helps out by giving you a "pay raise" (the match, dedicated to your retirement) of another $400/year. Even the IRS helps out, and you'd only see your paycheck drop by about $320/year. So, for less than $16 per paycheck, $800/year would be added to your account. After 30 years, your account would have over $180,000. The "9% Return" is arbitrary but realistic. Your actual average return will depend on the given funds you choose to invest in, and how they each perform. For less than $8/week (closer to $6 with the IRS factor considered) you can see that there will be a tremendous payout over time. How much have your lottery tickets earned you?

Curve assumes an average 4% pay raise. |

| Published by Lotus® Freelance Graphics® | Authored by Rich Franzen |

|